New Trump Administration Rule Would Override State Medical Debt Protections

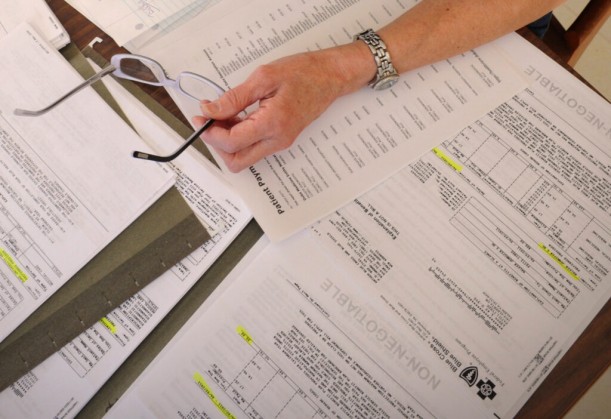

A cancer patient’s medical bills are spread on a kitchen table in a home in Salem, Va., in this 2011 photo. A new Trump administration rule would override more than a dozen state laws that shield consumers’ credit reports from medical debt. (Don Petersen / AP Photo)

A new Trump administration rule issued late last month would override state laws that prevent consumers’ credit reports from including medical debt, potentially weakening financial protections for millions of Americans.

In recent years, more than a dozen states have taken steps to keep medical debt from hurting residents’ credit scores, passing laws with bipartisan support. But new guidance from the federal Consumer Financial Protection Bureau repeals a Biden-era rule that allowed states to impose their own bans. The Trump administration has interpreted the 1970 Fair Credit Reporting Act to say that it overrides state laws around reporting debt to credit bureaus.

American consumers had at least $220 billion in unpaid medical bills in 2024, according to an analysis from research nonprofit KFF. About 6% of American adults, or 14 million people, owe more than $1,000 in medical debt.

“Medical debt is a tremendous weight keeping so many families from financial security, and, unlike most other forms of debt, it’s not a choice,” North Carolina Gov. Josh Stein, a Democrat, said last month in a statement announcing that a new state program had wiped out more than $6.5 billion in medical debt for more than 25 million North Carolinians.

People rarely plan to take on debt from medical care, as they do when they borrow money to buy a house or car. A one-time or short-term expense such as a single hospital stay causes about two-thirds of all medical debt, according to a 2022 Consumer Financial Protection Bureau report.

And even though most Americans have health insurance, many get stuck with unexpected medical bills because their policies have high deductibles or don’t fully cover some treatments, procedures or drugs. People in worse health and those living with a disability are more likely to report medical debt, as are middle-aged adults, Black Americans, and people with low and middle incomes, according to KFF.

In the past two years, a dozen states have passed laws forbidding medical debt from appearing on credit reports, bringing the total number of states with such laws to 14: California, Colorado, Connecticut, Illinois, Maine, Maryland, Minnesota, New Jersey, New York, North Carolina, Rhode Island, Vermont, Virginia and Washington.

Another five states — Delaware, Florida, Idaho, Nevada and Utah — limit how and when medical debt can appear on credit reports, according to the nonprofit Commonwealth Fund.

Republican and Democratic legislators in other states, including Michigan, Ohio and South Dakota, have introduced similar bills this year.

Now the new state laws face an uncertain future. In January, while Biden was still in office, the Consumer Financial Protection Bureau finalized a rule prohibiting credit reporting agencies from reporting medical debt in certain circumstances. Credit bureaus and credit unions sued to stop the rule. The incoming Trump administration agreed with the plaintiffs and declined to defend the rule in court, so a federal judge blocked it.

Maine state Sen. Donna Bailey, a Democrat, said in a September statement that Maine’s new law barring medical debt from appearing on consumer reports was even more important in light of the demise of the federal rule.

“Although Americans no longer have the federal protection, Mainers will continue to have protection here in our state,” she said in September. “When we go to the hospital for medical care, especially for emergencies, any debt that we take on should not hold us back from buying a car, renting a home or taking out a loan.”

But the Trump administration’s latest order would render state laws such as Maine’s moot.

Stateline reporter Anna Claire Vollers can be reached at avollers@stateline.org. This story was originally produced by Stateline, which is part of States Newsroom, a nonprofit news network which includes Nebraska Examiner, and is supported by grants and a coalition of donors as a 501c(3) public charity.

Category:

User login

Omaha Daily Record

The Daily Record

222 South 72nd Street, Suite 302

Omaha, Nebraska

68114

United States

Tele (402) 345-1303

Fax (402) 345-2351