Investors Prefer ‘I’ Over ‘We’ When CEOs Apologize

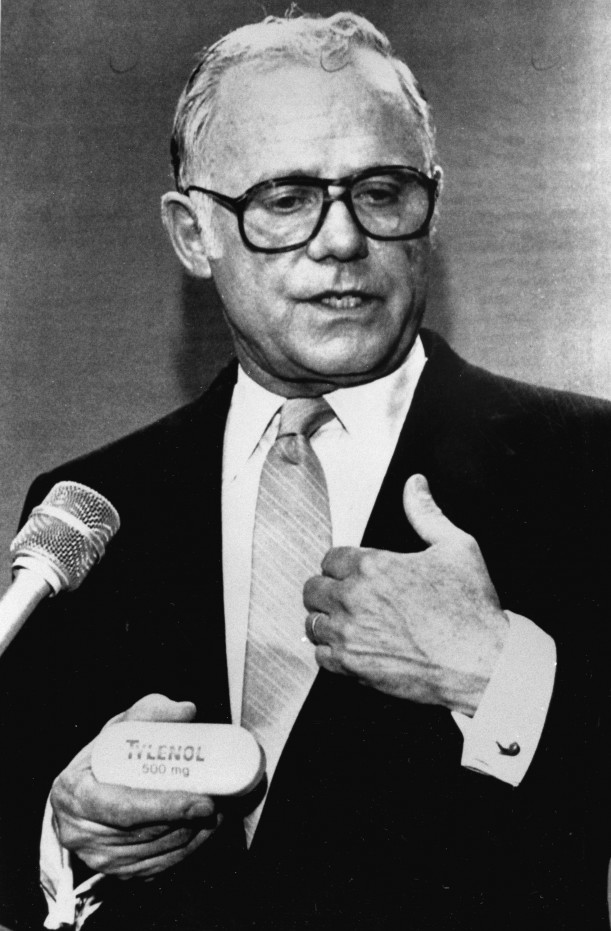

Johnson & Johnson Chairman James E. Burke holds a model of Tylenol caplet while speaking at a news conference in the corporation world headquarters in New Brunswick, N.J., Feb. 18, 1986. Burke announced that the production of Tylenol capsules will be halted because the company cannot prevent tampering with that product. (Tom Costello / AP Photo)

When corporate crises hit, the public looks to the CEO. From product recalls to workplace discrimination, to customer mistreatment scandals, CEOs are often thrust into the spotlight and forced to apologize.

But do the exact words they choose really matter?

I’m a professor of marketing, and my preliminary research suggests the answer is yes. In fact, they can even move stock prices.

A Tale Of 2 Apologies

Consider two examples from the not-too-distant past. When Samsung Electronics had to recall 2.5 million smartphones in 2016 due to battery fires, the company ran full-page ads in major American newspapers that said, “We are truly sorry.” Despite the apology, Samsung’s stock continued falling, wiping out billions of dollars in market value.

Contrast that with a famous case: the 1982 Tylenol crisis, in which seven people died after taking capsules that a still-unidentified criminal had laced with cyanide, circumventing the company’s safety protocols. The then-CEO of Tylenol’s parent company, Johnson & Johnson, said “I apologize” to consumers and immediately ordered a nationwide recall, costing the company over US$100 million. His direct acknowledgment of responsibility and swift action helped restore public trust and became a case study in effective crisis leadership. The company’s stock price didn’t take much of a hit, either.

While the two cases are different in many ways, together they illustrate a pattern my colleagues and I observed in our study: Markets respond differently to “I apologize” versus “We apologize.”

Investors Reward Personal Accountability

I collaborated with marketing professors Jennifer H. Tatara and Courtney B. Peters to analyze 224 corporate apologies between 1996 and 2023. Using event-study methods common in finance, we tracked unusual stock returns around apology announcements and linked them to how CEOs framed their statements.

Our results, which we are preparing for publication, were striking. CEOs who said “I apologize” often saw short-term stock returns rise by a statistically significant amount. CEOs who said “We apologize” saw no such effect. Saying “I apologize” lessens the market penalty by roughly 86%, we found.

We think this is because markets reward leaders who take individual responsibility. “I” signals personal accountability and decisiveness. “We,” by comparison, dilutes ownership of the problem.

But context matters, we found. When we zeroed in on diversity-related cases – those involving mistreatment based on race, gender, disability or LGBTQ+ status, for example – the positive effect of “I apologize” weakened or disappeared.

That’s because investors often interpret diversity crises as signs of systemic failure, rather than isolated mistakes. In those cases, investors, employees and the public may expect accountability that goes beyond the CEO. A lone “I apologize” can seem hollow, while “We apologize” may resonate more by acknowledging shared institutional responsibility.

Beyond CEOs: Why Stakeholders Should Care

Apologies are among the most scrutinized executive communications. Their effects ripple across different audiences.

For investors, apology language provides a real-time signal of leadership quality and future governance. Our research shows these signals are strong enough to move stock prices.

For corporate boards, an apology can be as important as a balance sheet in shaping market perceptions. Our research suggests that boards should insist leaders prepare for crisis communications as a standard part of risk management.

For employees and customers, apology language sends a message about corporate culture. “I” can demonstrate accountability; “we” can affirm inclusion and shared responsibility. Both matter, depending on the situation.

Leading In A Skeptical Era

Corporate apologies are nothing new. But in today’s environment – where social media amplifies every word and trust in institutions is fragile – the stakes are higher. A single poorly framed statement can trigger outrage, stock sell-offs or viral boycotts.

The good news is that “sorry” doesn’t have to be the hardest word. In fact, this research suggests that a good apology can pay off, literally. The key is to remember that apologies aren’t one-size-fits-all. The right words depend on the nature of the wrongdoing.

This article is republished from The Conversation, a nonprofit media outlet that uses academic and research content. Read the original article: https://theconversation.com/investors-prefer-i-over-we-when-ceos-apologi...

Category:

User login

Omaha Daily Record

The Daily Record

222 South 72nd Street, Suite 302

Omaha, Nebraska

68114

United States

Tele (402) 345-1303

Fax (402) 345-2351