VILLAGE OF BOYS TOWN PUBLIC NOTICES 8/13/2021

Notice of Special Meeting

of the Board of Trustees

Village of Boys Town

NOTICE IS HEREBY GIVEN that the Board of Trustees of the Village of Boys Town have called a special session open to the public to be held on Tuesday, August 24, 2021 at 1:30 p.m., and will be at Father Flanagan’s Boys’ Home Headquarters Building in the Auditorium, in the Village of Boys Town, NE. The following modifications to this meeting are hereby implemented:

1. There shall be made available the ability to call in to the meeting as follows:

a. Dial (531) 355-0000

b. Enter: (531) 355-1248 #

c. Enter # (no pin)

2. The meeting shall be governed by all the same rules, regulations, and guidelines as any other meeting.

The Board of Trustees reserves the right to adjourn into closed session as per Section 84-1410 of the Nebraska Revised Statutes.

An agenda of the subjects to be considered at the meeting, kept continually current, is and shall be available for public inspection at the office of the Village Attorney located at the Father Flanagan’s Boys’ Home Headquarters Building in the Village of Boys Town, NE.

Individuals requiring physical or sensory accommodation, who desire to attend or participate, please contact the Village Attorney’s office at (531) 355-1071 no later than 4:30 p.m. on the day preceding the meeting.

James Beckmann

Village Clerk

8/16 ZNEZ

––––––––––––––––––––––––––––––––

Minutes of Meeting of the Board of Trustees Village of Boys Town

July 6, 2021

The meeting of the Board of the Village of Boys Town was held at 1:30 p.m. on Tuesday, July 6, 2021 in the Headquarters Building of Father Flanagan’s Boys’ Home in the Village of Boys Town, Nebraska.

Call to Order:

Chair Skartvedt called the meeting to order at 1:33 p.m.

Notice of Meeting:

The Notice of Meeting was posted on June 29, 2021, to Beacon and in the following designated public places in the Village of Boys Town: Town Hall, Visitor’s Center, and Headquarters. The Notice of Meeting was also published in The Daily Record on June 29, 2021.

Pledge of Allegiance/

Moment of Silence:

The Pledge of Allegiance was recited.

Village Clerk Conducted Roll Call:

Village Board of Trustees:

• Kyle Skartvedt – Chair – Present

• Monsignor James Gilg – Trustee – Present

• Chris Haack – Trustee – Present

• Jeff Lindley – Trustee – Not Present

Also present:

• Judy Rasmussen – Treasurer – Present

• Bill Clark – Chief of Police – Present

• Dana Washington – Village Attorney – Present

• Brett Wawers – Village Engineer – Present via conference bridge

• James Beckmann – Village Clerk – Present

• John Kava – Fire Chief – Present

Consent Agenda and

Minutes of Prior Meeting:

Chair Skartvedt moved for approval of June 8, 2021 Minutes.

Upon MOTION duly made by Haack and seconded by Msgr. Gilg, the Consent Agenda and Minutes were accepted. The Village Clerk conducted roll call.

• Kyle Skartvedt – AYE

• Monsignor James Gilg – AYE

• Chris Haack – AYE

Motion carried: 3-0

Treasurer’s Report, Report on Claims

to Be Paid, Report on Prepaid Claims:

The Village Treasurer reviewed the May 2021 Financial Report with the Trustees. The balance of all funds as of May 31 collectively $426,154.54. Detailed reports of claims to be paid are attached herewith and become part of the minutes. Detailed reports of claims to be paid and prepaid claims are attached herewith and become part of the minutes. Chair Skartvedt solicited a motion for consideration of and to approve action on accounts of the Village Treasurer, to approve the Village General Fund allowance and payment of claims.

Upon MOTION duly made by Haack and seconded by Gilg, these matters were accepted. The Village Clerk conducted roll call:

• Kyle Skartvedt – AYE

• Monsignor James Gilg – AYE

• Chris Haack – AYE

Motion carried: 3-0

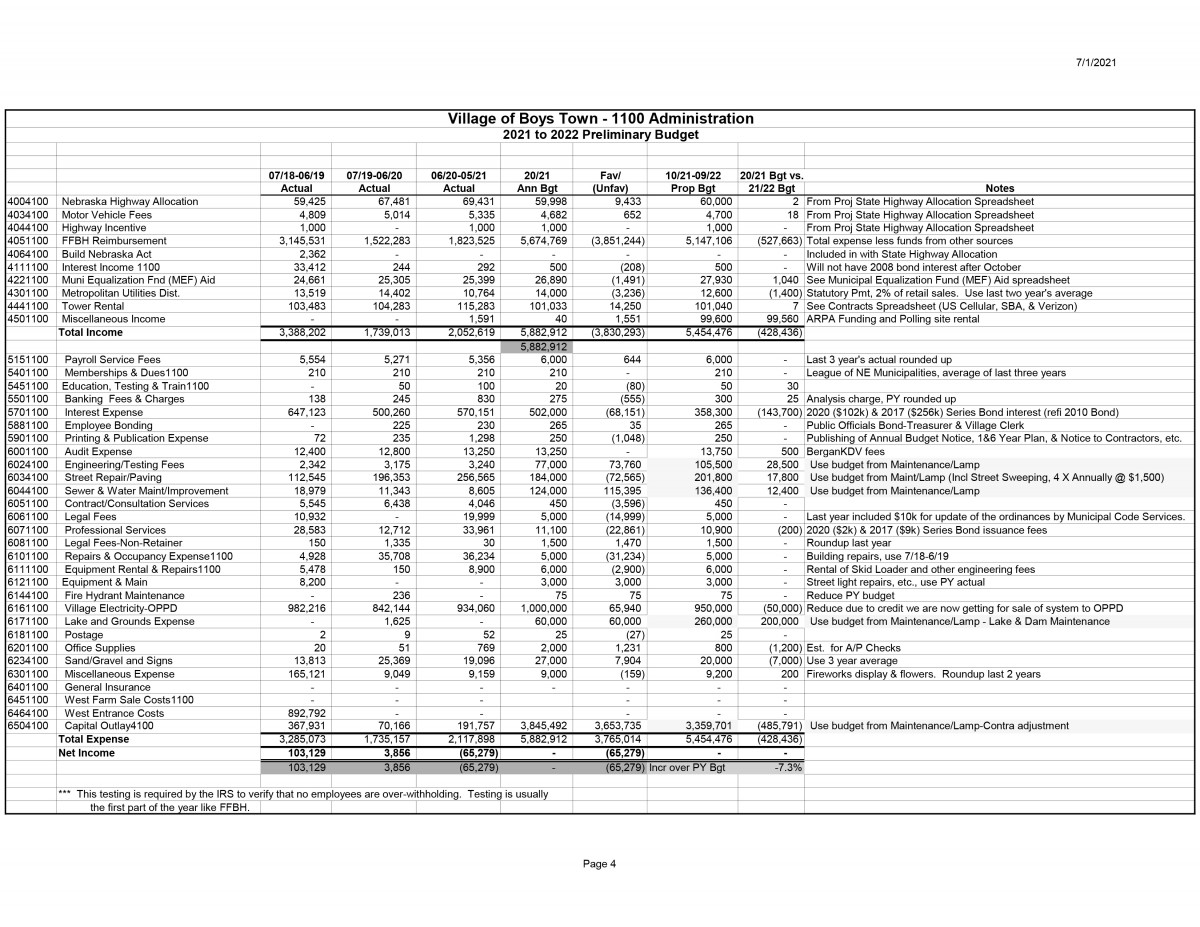

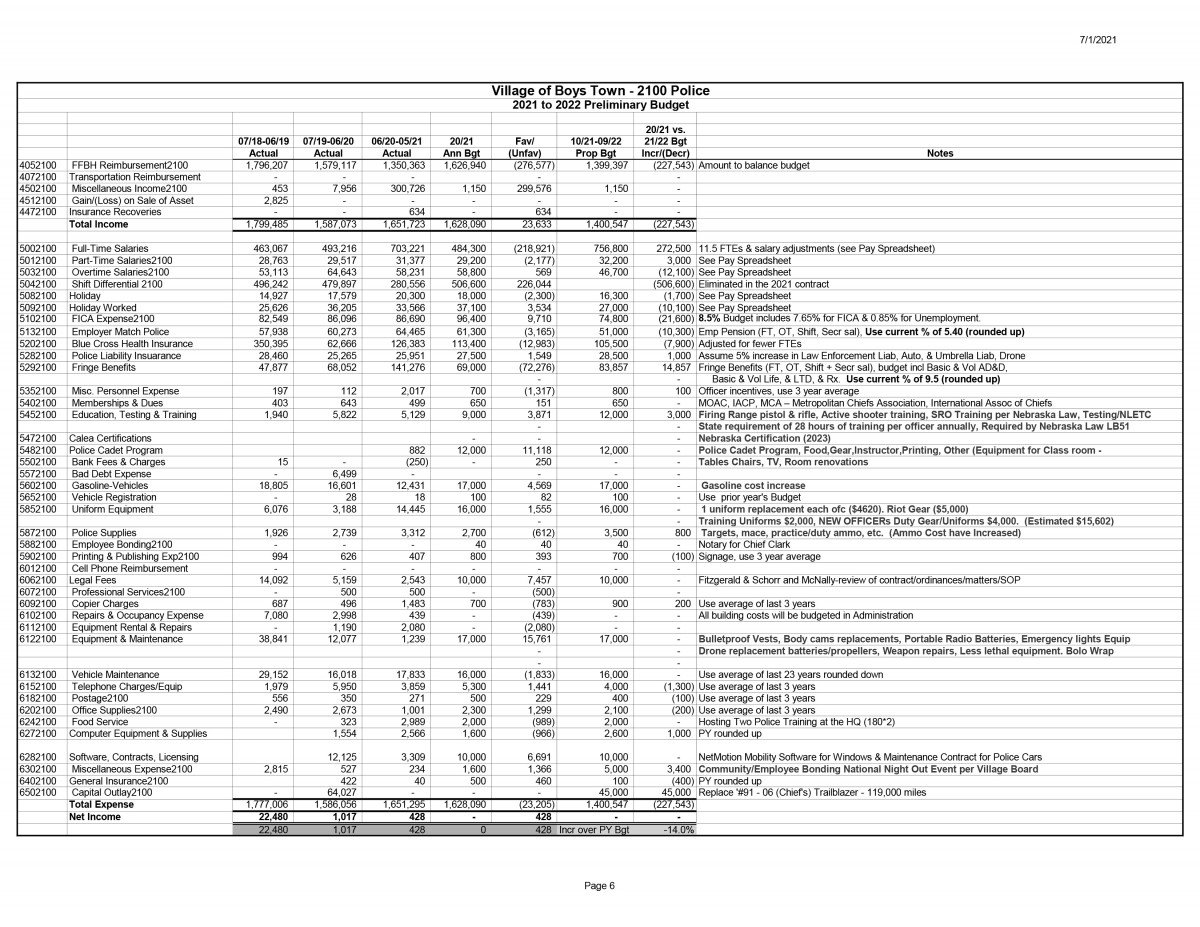

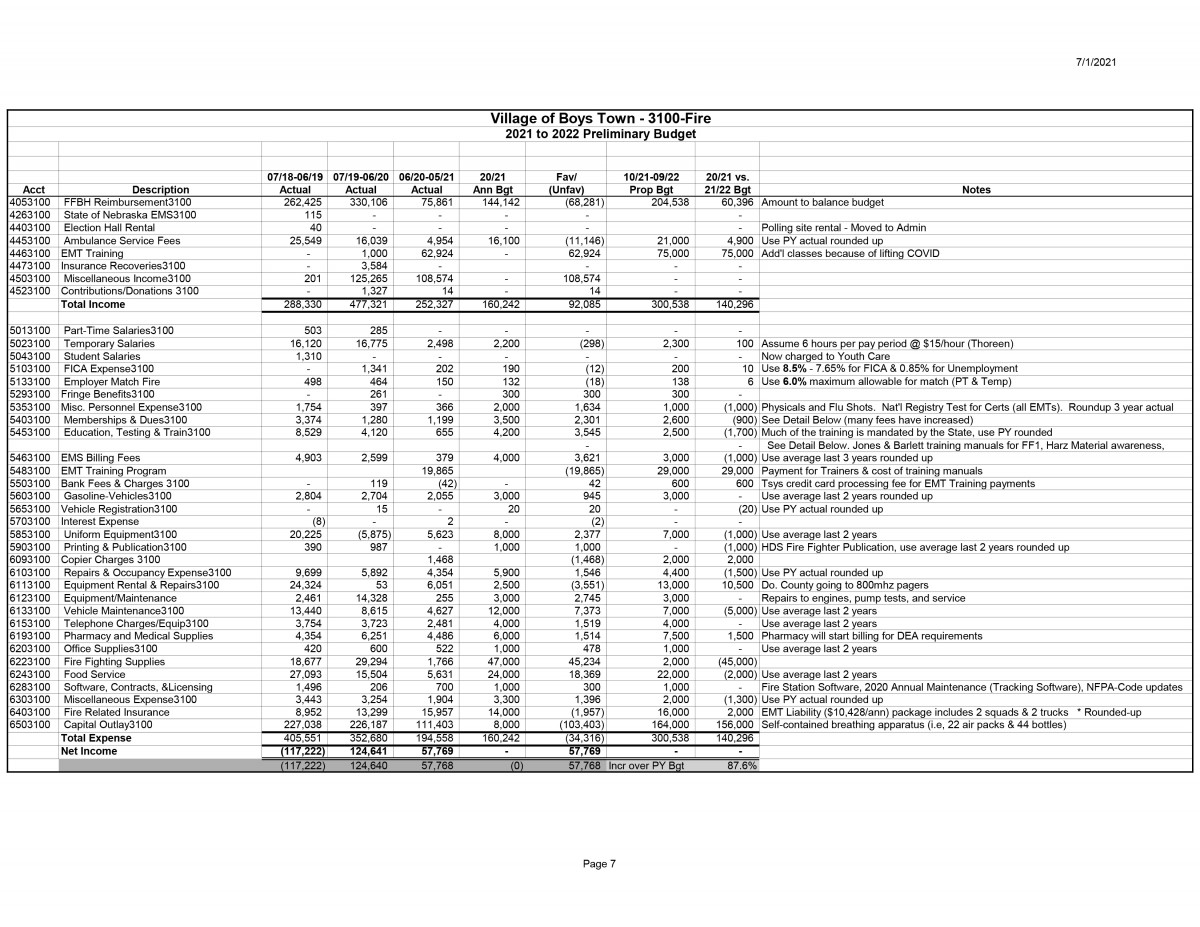

Presentation of 2021-2022

Preliminary Budget:

Village Treasurer Representative Tim Sharp presented the 2021-2022 Preliminary Budget for discussion. The Village Treasurer will present the full draft of the budget at the next regular meeting on August 3, 2021. The special budget hearing open to the public will be held on August 24, 2021 at 1:30PM and a vote on the final budget approval will be taken by the board at the regular meeting of the Village Board on September 7, 2021.

Report of the Village Police Chief:

Chief Clark gave an update on the Police Department’s staffing. The application process to fill the vacant FTE positions was closed. There were 11 non-certified and 4 certified applicants for police officer and background checks and testing are scheduled for July 11. The goal is to fill 2 FTEs with potentially a third to bring total police officers to 10. The department received 4 AEDs from the State of Nebraska from the Helmsley Grant and all police officers will be trained and certified with the new AEDs.

Report of the Village Fire Chief:

Chief Kava requested approval from the Board to purchase SCBAs (Self Contained Breathing Apparatus) in the amount of approximately $55,000.

Upon MOTION duly made by Msgr. Gilg and seconded by Haack, the Board approved the purchase of the SCBAs. The Village Clerk conducted roll call:

• Kyle Skartvedt – AYE

• Monsignor James Gilg – AYE

• Chris Haack – AYE

Motion carried: 3-0

Report of the Village

Engineer & Superintendent:

Brett Wawers provided an update on the Mother Theresa Lane Project. The bid from Mackie Construction was accepted and construction is scheduled to begin August 16, 2021. There are a few other minor repairs needed with the sewer on the East side which the City of Omaha owns and West side which Boys Town owns and that work will start soon. There is some concrete repair needed by Fr. Boes home.

Other Business:

Appointment of Interim Trustee

Chair Skartvedt put forth the name of candidate Joe West for the board members to vote on to serve out the remainder of former Trustee Wilson’s term through November 2022. The vote was unanimous and Joe West was appointed to serve as Interim Trustee for the remainder of this term, which is November 2022.

Approval of Acceptance of ARPA:

Municipal Allocation of

Coronavirus Local Fiscal Recovery

The Board voted to approve the application to accept approximately $99,500 for the ARPA: Municipal Allocation of Coronavirus Local Fiscal Recovery Funding.

Upon MOTION duly made by Haack and seconded by Msgr. Gilg, the Board approved the application to accept the approximately $99,500 for the ARPA: Municipal Allocation of Coronavirus Local Fiscal Recovery Funding. The Village Clerk conducted roll call:

• Kyle Skartvedt – AYE

• Monsignor James Gilg – AYE

• Chris Haack – AYE

Motion carried: 3-0

Next Meeting:

The next regular meeting of the Village Board will be held August 3, 2021 at 1:30PM. The special budget hearing open to the public will be held on Tuesday, August 24, 2021 at 1:30PM.

Adjournment:

There being no further business, upon motion duly made by Msgr. Gilg and seconded by Haack and carried by unanimous vote, the meeting adjourned at 2:06 p.m.

Motion carried: 3-0

Respectfully submitted,

James Beckmann, Village Clerk

Kyle Skartvedt, Chair of the Board

FINANCIAL REPORT

for the Month Ending

May 31, 2021

GENERAL FUND:

Balance Forward $ 297,453.72

Adjustments (i.e., Interest,

prior period) 0.00

Receipts for the Month 222,845.81

Less Warrants Issued (190,064.16)

Transfers 0.00

Less Bank Fees 0.00

Payroll Maxx Invoices - EFT Debit (397.40)

Payroll (67 .138.22)

Balance $ 262,699.75

EMS FUND:

Balance Forward 70,978.77

Adjustments (i.e., Interest,

prior period) 0.00

Receipts for the Month 5,364.63

Less Warrants Issued (50.37)

Transfers 0.00

Less Bank Fees 0.00

Balance $ 76,293.03

SAVINGS ACCOUNT:

Balance Forward $ 87,159.54

Adjustments (i.e., Interest,

prior period) 2.22

Transfers 0.00

Balance $ 87,161.76

ALL FUNDS:

General: $ 262,699.75

Savings: 87,161.76

EMS: 76,293.03

TOTAL FUNDS: $ 426, 154.54

JUDY F. RASMUSSEN

Treasurer of the Village of Boys Town

Village of Boys Town

06/03/21 Claims to be Approved

June 9 through July 5

06/09/2021 ACH Highmark, Inc. (338.74) 06/11/2021 Fraternal Order Of Police Lodge 35 (180.00) 06/11/2021 Boys Town Federal Credit Union (248.10) 06/11/2021 Vanguard (7,365.94) 06/11/2021 Agency ck (620.94) 06/11/2021 Payroll Maxx Fees (190.85) 06/11/2021 Record Payroll (24,520.23) 06/11/2021 Record Payroll (14,278.30) 06/16/2021 ACH Highmark, Inc. (2,887.55) 06/16/2021 ACH FFBH (54,018.26) 06/16/2021 15098 Guns Unlimited (19.98) 06/17/2021 15099 Blue Valley Public Safety, Inc. (264.44) 06/17/2021 15100 Bradley Harm (100.00) 06/17/2021 15101 Chad Lingel (40.00) 06/17/2021 15102 Cox Business (58.82) 06/17/2021 15103 Delta Dental of Nebraska (551.80) 06/17/2021 15104 Jessica Watts (60.00) 06/17/2021 15105 Kathleen M. Farris (360.00) 06/17/2021 15106 Konner Tourek (60.00) 06/17/2021 15107 Mandalyne R. Dore (200.00) 06/17/2021 15108 OPPD (59,882.62) 06/17/2021 15109 Papio-Missouri River Nat. Resources... (750.00) 06/17/2021 15110 Quick Med Claims (Formerly EMS Bi... (178.32) 06/24/2021 15111 Davis Vision, Inc. (166.20) 06/24/2021 15112 First National Bank Visa - Fire (3,756.98) 06/24/2021 15113 First National Bank Visa - Police (997.19) 06/25/2021 Fraternal Order Of Police Lodge 35 (140.00) 06/25/2021 Boys Town Federal Credit Union (248.10) 06/25/2021 Agency ck (620.94) 06/25/2021 Payroll Maxx Fees (163.85) 06/25/2021 Record Payroll (13,123.84) 06/25/2021 Record Payroll (6,442.49)

TOTAL (192,834.48)

Village of Boys Town

Prepaid Claims

As of July 6, 2021

Lamp, Rynearson & Associates, Inc. Bill 190025.00-0000158 07/01/2021 5,294.30 Total Lamp, Rynearson & Associates, Inc. 5,294.30

TOTAL 5,294.30

Village of Boys Town

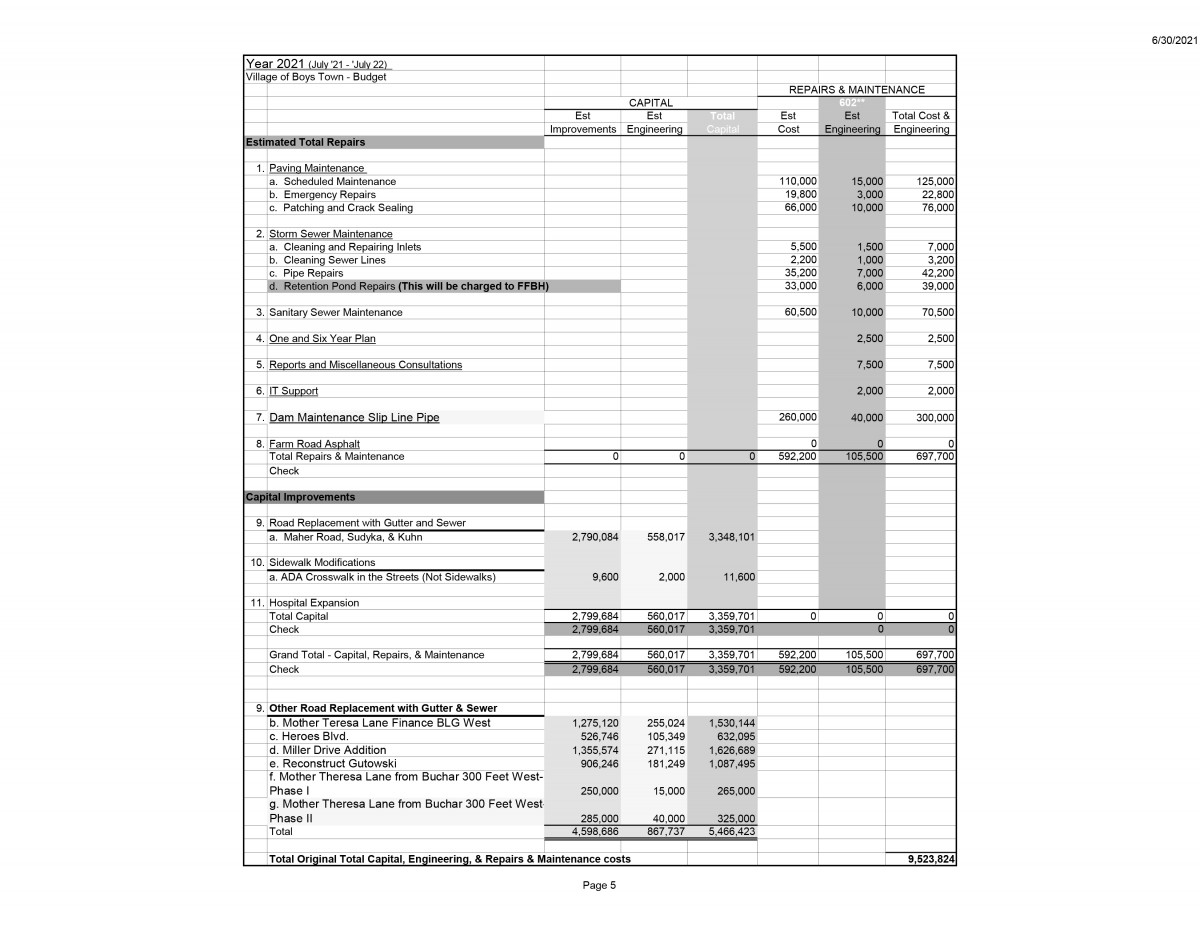

2021 to 2022 Preliminary Budget

10/21-09/22

07/18-06/19 07/19-06/20 06/20-05/21 10/20-09/21 Preliminary 20/21 Bgt vs. 20/21 Act vs.

Income Actual Actual Actual Budget Budget 21/22 Bgt 21/22 Bgt

Administration 3,388,203 1,739,013 2,052,619 5,882,912 5,454,476 (428,437) 3,401,856

Police Dept 1,799,485 1,587,073 1,651,723 1,628,090 1,400,547 (227,543) (251,176)

Fire Dept 288,330 477,321 252,327 160,242 300,538 140,296 48,211

Total Income 5,476,018 3,803,408 3,956,669 7,671,244 7,155,561 (515,684) 3,198,892

Expense

Administration 2,024,350 1,664,991 1,926,141 2,037,420 2,094,775 57,354 168,634

Police Dept 1,777,006 1,522,029 1,651,295 1,628,090 1,355,547 (272,543) (295,748)

Fire Dept 178,514 126,493 83,155 152,242 136,538 (15,704) 53,383

Total Expense 3,979,869 3,313,513 3,660,590 3,817,752 3,586,860 (230,893) (73,731)

Capital

Administration 1,260,723 70,166 191,757 3,845,492 3,359,701 (485,791) 3,167,944

Police Dept - 64,027 - - 45,000 45,000 45,000

Fire Dept 227,038 226,187 111,403 8,000 164,000 156,000 52,597

Total Capital 1,487,761 360,380 303,161 3,853,492 3,568,701 (284,791) 3,265,540

Total Exp & Cap 5,467,630 3,673,894 3,963,751 7,671,244 7,155,561 (515,684) 3,191,810

Net Income 8,388 129,514 (7,082) - - 0 7,082

Administration 3,285,073 1,735,157 2,117,898 5,882,912 5,454,476 (428,437) 3,336,577

Police Dept 1,777,006 1,586,056 1,651,295 1,628,090 1,400,547 (227,543) (250,748)

Fire Dept 405,551 352,680 194,558 160,242 300,538 140,296 105,980

Total Operating

Exp & Capital 5,467,630 3,673,894 3,963,751 7,671,244 7,155,561 (515,684) 3,191,810

Village of Boys Town

2021 to 2022 Preliminary Budget

Explanation of the Change From 20/21 to 21/22 Budget

Area Explanation Incr/(Decr)

Operating Expense:

Administration Increase in Lake and Grounds Expense - Dam Maintenance Slip Line Pipe 200,000

Increase in Engineering/Testing Fees 28,500

Increase in Street Repair/Paving 17,800

Increase in Sewer & Water Maint/Improvement 12,400

Decreased in Interest Expense - Refinancing of 2010 Bond Series (143,700)

Decreased in Village Electricity due to credit for sale of system to OPPD (50,000)

Decrease in Sand/Gravel and Signs (7,000)

Other (645)

Police Dept. New Community/Employee Bonding National Night Out Event 3,400

Increase in Education, Testing & Training - Firing Range pistol/rifle, Active shooter training, etc. 3,000

Decrease in Salary Related Costs - fewer FTEs budgeted (255,000)

Decrease in Net Fringe Benefits/Taxes - fewer FTEs budgeted (23,943)

Other -

Fire Dept. Increase in EMT Training cost due to new program 29,000

Increase in Equipment Rental & Repairs - Do. County going to 800mhz pagers 10,500

Decrease in Fire Fighting Supplies - Budgeted for Assistance to Fire Fighters Grant in PY (45,000)

Decrease in Uniform/Equipment/Maintenance (1,000)

Decrease in Vehicle Maintenance (5,000)

Decrease in Education & Testing (1,700)

Other (2,504)

Total Increase/(Decrease) in Operating Expense (230,892)

Capital:

Administration Net Decrease in Capital Spending - Primarily due to Hospital Expansion budget in PY (485,791)

Police Dept. Increase in Capital Spending - Replace ‘#91 - 06 (Chief’s) Trailblazer - 119,000 miles 45,000

Fire Dept. Net Decrease in Capital Spending - Self-contained breathing apparatus 156,000

Total Increase/(Decrease) in Capital (284,791)

Total Increase/(Decrease) in Operating Expense & Capital (515,683)

** See Lamp Detailed Project List

Village of Boys Town

2021 to 2022 Preliminary Budget

Explanation of the 06/20-05/21 Actual vs. 21/22 Budget Variance

Area Explanation Incr/(Decr)

Operating Expense:

Administration Unspent Lake and Grounds Expense 260,000

Unspent Sewer & Water Maint/Improvement 127,795

Unspent Engineering/Testing Fees 102,260

Decreased in Interest Expense - Refinancing of 2010 Bond Series (211,851)

Unspent Street Repair/Paving (54,765)

Decrease in Repairs & Occupancy - Town Hall (31,234)

Decrease in Professional Fees (Bond issuance fees) - Refi of 2010 Bond Series (23,061)

Other (511)

Police Dept. Increase in Equipment & Maintenance - Duty Response Gear, Training Uniforms 1 5,761

Startup of New Police Cadet Program 11,118

Increase in Legal Fees - Contract/ordinances/matters/SOP 7,457

Increase in Education, Testing & Training 6,871

Increase in Software, Contracts, Licensing 6,691

Decrease in Salary Related Costs including Fringe Benefits/Taxes - fewer FTEs (349,359)

Other 5,714

Fire Dept. Increase - Lower than normal Food Service cost in PY 16,369

Increase in Equipment Rental & Repairs - Do. County going to 800mhz pagers 6,949

Increase in Memberships & Dues/ Education, Testing & Train 3,246

Increase in Pharmacy and Medical Supplies 3,014

Increase in Equipment/Maintenance 2,745

Increase in EMS Billing Fees 2,621

Increase in Vehicle Maintenance3100 2,373

Other 16,066

Total Increase/(Decrease) in Operating Expense (73,731)

Capital:

Administration Unspent Capital Projects in PY 3,167,944

Police Dept. Increase in Capital Spending - Replace ‘#91 - 06 (Chief’s) Trailblazer - 119,000 miles 45,000

Fire Dept. Net Decrease in Capital Spending - Remaining Cost for New Pumper Truck in PY 52,597

Total Increase/(Decrease) in Capital 3,265,540

Total Increase/(Decrease) in Operating Expense & Capital 3,191,810

** See Lamp Detailed Project List

Village of Boys Town

2021 to 2022 Preliminary Budget

Requested Funding from FFBH

Fiscal Year

10/21-09/22

Proposed Budget

Total Expenditures 3,586,860

Total Capital * 3,568,701

Total Operating Exp & Capital Incl Debt Service 7,155,561

Less: Capital that Probably

Won’t be Completed in 2021/22: 3,348,101

Net Operating Exp & Capital 3,807,460

Less: Funds From Other Sources

ARPA Funding and Polling site rental 99,600

Nebraska Highway Allocation 60,000

Motor Vehicle Fees 4,700

Highway Incentive 1,000

Interest Income 1100 500

Muni Equalization Fnd (MEF) Aid 27,930

Metropolitan Utilities Dist. 12,600

Tower Rental 101,040

EMT Training Fees 75,000

Ambulance Service Fees 21,000

Total Funds From Other Sources 403,370

Requested Funding from FFBH (Net Expense) 3,404,090

FFBH Reimbursement 6/20-5/21 3,249,749

Increase/(Decrease) in Funding from PY - $ 154,341

Increase/(Decrease) in Funding from PY - % 4.7%

* Includes Maher Road, Sudyka, & Kuhn & ADA Cross

walks projects ONLY (See Lamp summary)

American Rescue Plan Act

Coronavirus Local Fiscal Recovery Fund

Non-Entitlement Units of Local

Government Application

Name of City or Village (NEU):

Village of Boys Town

Section I

√ Option I: Request allocation of local fiscal recovery funds based on the proportion of the population in the NEU as a share of the total population of all NEUs in the State (see initial calculation attached).

Section II

Taxpayer Identification Number of City/Village:

47-0615594

DUNS Number of City/Village:

081080495

Address of City Hall/Village Office:

14100 Crawford Street,

Boys Town, NE, 68010

Authorized Representative of City/Village

Judy F. Rasmussen

Treasurer

Judy. Rasmussen@boystown.org

Contact Person in City/Village:

Timothy D. Sharp

Financial Officer

(531) 355-3151

Financial Institution Information: [Withheld]

Section III

√ I have reviewed the provided list of NEU operating budgets in effect as of January 27, 2020, and agree our listed amount accurately reflects our budget (defined as the annual total operating budget, including general fund and other funds). Budget numbers were extracted from the Auditor of Public Accounts Budget Database for the budget period October 1, 2019 through September 30, 2020.

√ I have reviewed and signed the US Treasury Award Terms and Conditions Agreement to be returned to the State with this agreement.

√ I have reviewed and signed the Assurances of Compliance with Title VI of the Civil Rights Act of 1964 to be returned to the State with this agreement.

Section IV

Authorized Representative Signature:

/s/ Judy F. Rasmussen

U.S. DEPARTMENT OF THE TREASURY

CORONA VIRUS STATE AND LOCAL

FISCAL RECOVERY FUNDS

Village of Boys Town

14100 Crawford Street, Boys Town, NE 68010

DUNS Number: 081080495

Taxpayer Identification Number: 47-0615594

Assistance Listing Number: 21.027

Sections 602(b) and 603(b) of the Social Security Act (the Act) as added by section 9901 of the American Rescue Plan Act, Pub. L. No. 117-2 (March 11, 2021) authorize the Department of the Treasury (Treasury) to make payments to certain recipients from the Coronavirus State Fiscal Recovery Fund and the Coronavirus Local Fiscal Recovery Fund.

Recipient hereby agrees, as a condition to receiving such payment from Treasury, to the terms attached hereto.

/s/ Judy F. Rasmussen

Treasurer, June 23, 2021

U.S. DEPARTMENT OF THE TREASURY

CORONA VIRUS LOCAL FISCAL RECOVERY FUND

AWARD TERMS AND CONDITIONS

1. Use of Funds.

a. Recipient understands and agrees that the funds disbursed under this award may only be used in compliance with section 603(c) of the Social Security Act (the Act), Treasury’s regulations implementing that section, and guidance issued by Treasury regarding the foregoing.

b. Recipient will determine prior to engaging in any project using this assistance that it has the institutional, managerial, and financial capability to ensure proper planning, management, and completion of such project.

2. Period of Performance. The period of performance for this award begins on the date hereof and ends on December 31, 2026. As set forth in Treasury’s implementing regulations, Recipient may use award funds to cover eligible costs incurred during the period that begins on March 3, 2021, and ends on December 31, 2024.

3. Reporting. Recipient agrees to comply with any reporting obligations established by Treasury as they relate to this award.

4. Maintenance of and Access to Records

a. Recipient shall maintain records and financial documents sufficient to evidence compliance with section 603(c) of the Act, Treasury’s regulations implementing that section, and guidance issued by Treasury regarding the foregoing.

b. The Treasury Office of Inspector General and the Government Accountability Office, or their authorized representatives, shall have the right of access to records (electronic and otherwise) of Recipient in order to conduct audits or other investigations.

c. Records shall be maintained by Recipient for a period of five (5) years after all funds have been expended or returned to Treasury, whichever is later.

5. Pre-award Costs. Pre-award costs, as defined in 2 C.F.R. § 200.458, may not be paid with funding from this award.

6. Administrative Costs. Recipient may use funds provided under this award to cover both direct and indirect costs.

7. Cost Sharing. Cost sharing or matching funds are not required to be provided by Recipient.

8. Conflicts of Interest. Recipient understands and agrees it must maintain a conflict of interest policy consistent with 2 C.F.R. § 200.318(c) and that such conflict of interest policy is applicable to each activity funded under this award. Recipient and subrecipients must disclose in writing to Treasury or the pass-through entity, as appropriate, any potential conflict of interest affecting the awarded funds in accordance with 2 C.F.R. § 200.112.

9. Compliance with Applicable Law and Regulations.

a. Recipient agrees to comply with the requirements of section 603 of the Act, regulations adopted by Treasury pursuant to section 603(f) of the Act, and guidance issued by Treasury regarding the foregoing. Recipient also agrees to comply with all other applicable federal statutes, regulations, and executive orders, and Recipient shall provide for such compliance by other parties in any agreements it enters into with other parties relating to this award.

b. Federal regulations applicable to this award include, without limitation, the following:

i. Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards, 2 C.F.R. Part 200, other than such provisions as Treasury may determine are inapplicable to this Award and subject to such exceptions as may be otherwise provided by Treasury. Subpart F - Audit Requirements of the Uniform Guidance, implementing the Single Audit Act, shall apply to this award.

ii. Universal Identifier and System for Award Management (SAM), 2 C.F.R. Part 25, pursuant to which the award term set forth in Appendix A to 2 C.F.R. Part 25 is hereby incorporated by reference.

iii. Reporting Subaward and Executive Compensation Information, 2 C.F.R. Part 170, pursuant to which the award term set forth in Appendix A to 2 C.F.R. Part 170 is hereby incorporated by reference.

iv. OMB Guidelines to Agencies on Governmentwide Debarment and Suspension (Nonprocurement), 2 C.F.R. Part 180, including the requirement to include a term or condition in all lower tier covered transactions (contracts and subcontracts described in 2 C.F.R. Part 180, subpart B) that the award is subject to 2 C.F.R. Part 180 and Treasury’s implementing regulation at 31 C.F.R. Part 19.

v. Recipient Integrity and Performance Matters, pursuant to which the award term set forth in 2 C.F.R. Part 200, Appendix XII to Part 200 is hereby incorporated by reference.

vi. Governmentwide Requirements for Drug-Free Workplace, 31 C.F.R. Part 20.

vii. New Restrictions on Lobbying, 31 C.F.R. Part 21.

viii. Uniform Relocation Assistance and Real Property Acquisitions Act of 1970 (42 U.S.C. §§ 4601-4655) and implementing regulations.

ix. Generally applicable federal environmental laws and regulations.

c. Statutes and regulations prohibiting discrimination applicable to this award include, without limitation, the following:

i. Title VI of the Civil Rights Act of 1964 (42 U.S.C. §§ 2000d et seq.) and Treasury’s implementing regulations at 31 C.F.R. Part 22, which prohibit discrimination on the basis of race, color, or national origin under programs or activities receiving federal financial assistance;

ii. The Fair Housing Act, Title VIII of the Civil Rights Act of 1968 (42 U.S.C. §§ 3601 et seq.), which prohibits discrimination in housing on the basis of race, color, religion, national origin, sex, familial status, or disability;

iii. Section 504 of the Rehabilitation Act of 1973, as amended (29 U.S.C. § 794), which prohibits discrimination on the basis of disability under any program or activity receiving federal financial assistance;

iv. The Age Discrimination Act of 1975, as amended (42 U.S.C. §§ 6101 et seq.), and Treasury’s implementing regulations at 31 C.F.R. Part 23, which prohibit discrimination on the basis of age in programs or activities receiving federal financial assistance; and

v. Title II of the Americans with Disabilities Act of 1990, as amended (42 U.S.C. §§ 12101 et seq.), which prohibits discrimination on the basis of disability under programs, activities, and services provided or made available by state and local governments or instrumentalities or agencies thereto.

10. Remedial Actions. In the event of Recipient’s noncompliance with section 603 of the Act, other applicable laws, Treasury’s implementing regulations, guidance, or any reporting or other program requirements, Treasury may impose additional conditions on the receipt of a subsequent tranche of future award funds, if any, or take other available remedies as set forth in 2 C.F.R. § 200.339. In the case of a violation of section 603(c) of the Act regarding the use of funds, previous payments shall be subject to recoupment as provided in section 603(e) of the Act.

11. Hatch Act. Recipient agrees to comply, as applicable, with requirements of the Hatch Act (5 U.S.C. §§ 1501-1508 and 7324-7328), which limit certain political activities of State or local government employees whose principal employment is in connection with an activity financed in whole or in part by this federal assistance.

12. False Statements. Recipient understands that making false statements or claims in connection with this award is a violation of federal law and may result in criminal, civil, or administrative sanctions, including fines, imprisonment, civil damages and penalties, debarment from participating in federal awards or contracts, and/or any other remedy available by law.

13. Publications. Any publications produced with funds from this award must display the following language: “This project [is being] [was] supported, in whole or in part, by federal award number [enter project FAIN] awarded to [name of Recipient] by the U.S. Department of the Treasury.”

14. Debts Owed the Federal Government.

a. Any funds paid to Recipient (1) in excess of the amount to which Recipient is finally determined to be authorized to retain under the terms of this award; (2) that are determined by the Treasury Office of Inspector General to have been misused; or (3) that are determined by Treasury to be subject to a repayment obligation pursuant to section 603(e) of the Act and have not been repaid by Recipient shall constitute a debt to the federal government.

b. Any debts determined to be owed the federal government must be paid promptly by Recipient. A debt is delinquent if it has not been paid by the date specified in Treasury’s initial written demand for payment, unless other satisfactory arrangements have been made or if the Recipient knowingly or improperly retains funds that are a debt as defined in paragraph 14(a). Treasury will take any actions available to it to collect such a debt.

15. Disclaimer.

a. The United States expressly disclaims any and all responsibility or liability to Recipient or third persons for the actions of Recipient or third persons resulting in death, bodily injury, property damages, or any other losses resulting in any way from the performance of this award or any other losses resulting in any way from the performance of this award or any contract, or subcontract under this award.

b. The acceptance of this award by Recipient does not in any way establish an agency relationship between the United States and Recipient.

16. Protections for Whistleblowers.

a. In accordance with 41 U.S.C. § 4712, Recipient may not discharge, demote, or otherwise discriminate against an employee in reprisal for disclosing to any of the list of persons or entities provided below, information that the employee reasonably believes is evidence of gross mismanagement of a federal contract or grant, a gross waste of federal funds, an abuse of authority relating to a federal contract or grant, a substantial and specific danger to public health or safety, or a violation of law, rule, or regulation related to a federal contract (including the competition for or negotiation of a contract) or grant.

b. The list of persons and entities referenced in the paragraph above includes the following:

i. A member of Congress or a representative of a committee of Congress;

ii. An Inspector General;

iii. The Government Accountability Office;

iv. A Treasury employee responsible for contract or grant oversight or management;

v. An authorized official of the Department of Justice or other law enforcement agency;

vi. A court or grand jury; or

vii. A management official or other employee of Recipient, contractor, or subcontractor who has the responsibility to investigate, discover, or address misconduct.

c. Recipient shall inform its employees in writing of the rights and remedies provided under this section, in the predominant native language of the workforce.

17. Increasing Seat Belt Use in the United States. Pursuant to Executive Order 13043, 62 FR 19217 (Apr. 18, 1997), Recipient should encourage its contractors to adopt and enforce on-the-job seat belt policies and programs for their employees when operating company-owned, rented or personally owned vehicles.

18. Reducing Text Messaging While Driving. Pursuant to Executive Order 13513, 74 FR 51225 (Oct. 6, 2009), Recipient should encourage its employees, subrecipients, and contractors to adopt and enforce policies that ban text messaging while driving, and Recipient should establish workplace safety policies to decrease accidents caused by distracted drivers.

ASSURANCES OF COMPLIANCE WITH CIVIL RIGHTS REQUIREMENTS

ASSURANCES OF COMPLIANCE WITH TITLE VI OF THE CIVIL RIGHTS ACT OF 1964

As a condition of receipt of federal financial assistance from the Department of the Treasury, the recipient named below (hereinafter referred to as the “Recipient”) provides the assurances stated herein. The federal financial assistance may include federal grants, loans and contracts to provide assistance to the Recipient’s beneficiaries, the use or rent of Federal land or property at below market value, Federal training, a loan of Federal personnel, subsidies, and other arrangements with the intention of providing assistance. Federal financial assistance does not encompass contracts of guarantee or insurance, regulated programs, licenses, procurement contracts by the Federal government at market value, or programs that provide direct benefits.

The assurances apply to all federal financial assistance from or funds made available through the Department of the Treasury, including any assistance that the Recipient may request in the future.

The Civil Rights Restoration Act of 1987 provides that the provisions of the assurances apply to all of the operations of the Recipient’s program(s) and activity(ies), so long as any portion of the Recipient’s program(s) or activity(ies) is federally assisted in the manner prescribed above.

1. Recipient ensures its current and future compliance with Title VI of the Civil Rights Act of 1964, as amended, which prohibits exclusion from participation, denial of the benefits of, or subjection to discrimination under programs and activities receiving federal financial assistance, of any person in the United States on the ground of race, color, or national origin (42 U.S.C. § 2000d et seq.), as implemented by the Department of the Treasury Title VI regulations at 31 CPR Part 22 and other pertinent executive orders such as Executive Order 13166, directives, circulars, policies, memoranda, and/or guidance documents.

2. Recipient acknowledges that Executive Order 13166, “Improving Access to Services for Persons with Limited English Proficiency,” seeks to improve access to federally assisted programs and activities for individuals who, because of national origin, have Limited English proficiency (LEP). Recipient understands that denying a person access to its programs, services, and activities because of LEP is a form of national origin discrimination prohibited under Title VI of the Civil Rights Act of 1964 and the Department of the Treasury’s implementing regulations. Accordingly, Recipient shall initiate reasonable steps, or comply with the Department of the Treasury’s directives, to ensure that LEP persons have meaningful access to its programs, services, and activities. Recipient understands and agrees that meaningful access may entail providing language assistance services, including oral interpretation and written translation where necessary, to ensure effective communication in the Recipient’s programs, services, and activities.

3. Recipient agrees to consider the need for language services for LEP persons when Recipient develops applicable budgets and conducts programs, services, and activities. As a resource, the Department of the Treasury has published its LEP guidance at 70 FR 6067. For more information on taking reasonable steps to provide meaningful access for LEP persons, please visit http://www.lep.gov.

4. Recipient acknowledges and agrees that compliance with the assurances constitutes a condition of continued receipt of federal financial assistance and is binding upon Recipient and Recipient’s successors, transferees, and assignees for the period in which such assistance is provided.

5. Recipient acknowledges and agrees that it must require any sub-grantees, contractors, subcontractors, successors, transferees, and assignees to comply with assurances 1-4 above, and agrees to incorporate the following language in every contract or agreement subject to Title VI and its regulations between the Recipient and title Recipient’s sub-grantees, contractors, subcontractors, successors, transferees, and assignees:

The sub-grantee, contractor, subcontractor, successor, transferee, and assignee shall comply with Title VI of the Civil Rights Act of 1964, which prohibits recipients of federal financial assistance from excluding from a program or activity, denying benefits of, or otherwise discriminating against a person on the basis of race, color, or national origin (42 U.S. C. § 2000d et seq.), as implemented by the Department of the Treasury’s Title VI regulations, 31 CFR Part 22, which are herein incorporated by reference and made a part of this contract (or agreement). Title VI also includes protection to persons with “Limited English Proficiency” in any program or activity receiving federal financial assistance, 42 U.S.C.§ 2000d et seq., as implemented by the Department of the Treasury’s Title VI regulations, 31 CFR Part 22, and herein incorporated by reference and made a part of this contract or agreement.

6. Recipient understands and agrees that if any real property or structure is provided or improved with the aid of federal financial assistance by the Department of the Treasury, this assurance obligates the Recipient, or in the case of a subsequent transfer, the transferee, for the period during which the real property or structure is used for a purpose for which the federal financial assistance is extended or for another purpose involving the provision of similar services or benefits. If any personal property is provided, this assurance obligates the Recipient for the period during which it retains ownership or possession of the property.

7. Recipient shall cooperate in any enforcement or compliance review activities by the Department of the Treasury of the aforementioned obligations. Enforcement may include investigation, arbitration, mediation, litigation, and monitoring of any settlement agreements that may result from these actions. The Recipient shall comply with information requests, on-site compliance reviews and reporting requirements.

8. Recipient shall maintain a complaint log and inform the Department of the Treasury of any complaints of discrimination on the grounds of race, color, or national origin, and limited English proficiency covered by Title VI of the Civil Rights Act of 1964 and implementing regulations and provide, upon request, a list of all such reviews or proceedings based on the complaint, pending or completed, including outcome. Recipient also must inform the Department of the Treasury if Recipient has received no complaints under Title VI.

9. Recipient must provide documentation of an administrative agency’s or court’s findings of non-compliance of Title VI and efforts to address the non-compliance, including any voluntary compliance or other agreements between the Recipient and the administrative agency that made the finding. If the Recipient settles a case or matter alleging such discrimination, the Recipient must provide documentation of the settlement. If Recipient has not been the subject of any court or administrative agency finding of discrimination, please so state.

10. If the Recipient makes sub-awards to other agencies or other entities, the Recipient is responsible for ensuring that sub-recipients also comply with Title VI and other applicable authorities covered in this document State agencies that make sub-awards must have in place standard grant assurances and review procedures to demonstrate that that they are effectively monitoring the civil rights compliance of subrecipients.

The United States of America has the right to seek judicial enforcement of the terms of this assurances document and nothing in this document alters or limits the federal enforcement measures that the United States may take in order to address violations of this document or applicable federal law.

Under penalty of perjury, the undersigned official(s) certifies that official(s) has read and understood the Recipient’s obligations as herein described, that any information submitted in conjunction with this assurances document is accurate and complete, and that the Recipient is in compliance with the aforementioned nondiscrimination requirements.

Village of Boys Town

June 23, 2021

/s/ Judy F. Rasmussen

Authorized Official

8/16 ZNEZ

––––––––––––––––––––––––––––––––

Category:

User login

Omaha Daily Record

The Daily Record

222 South 72nd Street, Suite 302

Omaha, Nebraska

68114

United States

Tele (402) 345-1303

Fax (402) 345-2351